META Stock Soars and Options Volume Explodes - Is META Fully Valued?

/Meta%20by%20creativeneko%20via%20Shutterstock.jpg)

Meta Platforms, Inc. (META) reported stellar Q2 earnings results, although free cash flow was lower due to higher capital expenditures. FOMO trading in META stock is pushing put premiums higher in unusually heavy trading. Is META fully valued?

META is at $780.56, up over 12% today after releasing its Q2 results yesterday. Investors are impressed that Meta's revenue rose over +22% YoY to $47.5 billion from $39.07 billion last year. That was +$2.68 billion higher or +6% more than the market was expecting, according to Seeking Alpha.

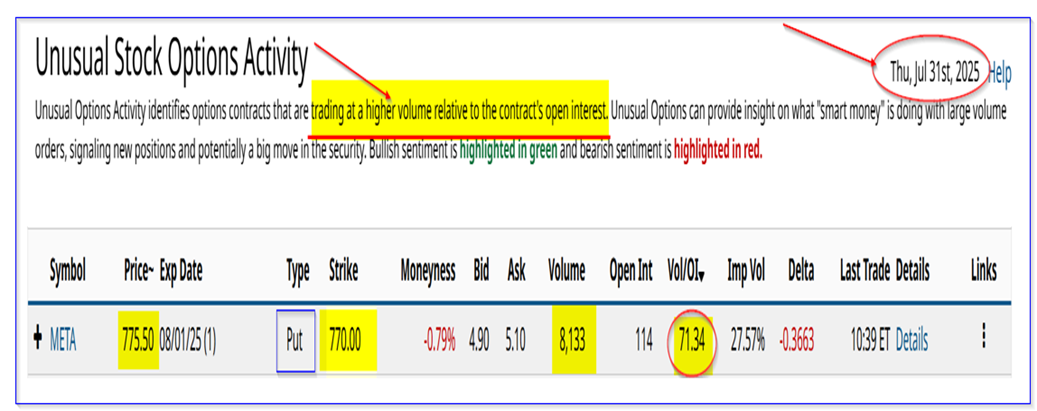

As a result, fear of missing out (FOMO) trading is flooding META trading and pushing its options volume through the roof. This can be seen in today's Barchart Unusual Stock Options Activity Report.

It shows that over 8,100 put option contracts have traded at the $770 strike price expiring tomorrow, Aug. 1, 2025. That is less than 1.0% below today's price (i.e., out-of-the-money), but the premium paid is $5.00 at the midpoint.

In other words, put option buyers expect to see the META stock fall below $765.00 ($770.00 - $5.00 premium) by the end of trading tomorrow. That would mean it would fall 1.49% from today's price.

Moreover, investors who are selling short these puts receive $5.00 for their $770.00 investment, a yield of 0.649% in just one day. If that can be repeated 4x a month like this (i.e., one day before weekly expiration), an investor has a monthly expected return (ER) of 2.60%.

These investors also have a lower breakeven price, even if the stock falls. That allows them to buy in at $765.00.

What is META Stock Worth Now?

The issue is whether META stock is worth this huge increase. It may be.

My last Barchart article on July 4 ("Meta Platforms Stock Looks Cheap - Short OTM Puts for a 2% One-Month Yield") showed that META could be worth $854.19 per share based on its free cash flow (FCF) and FCF margins.

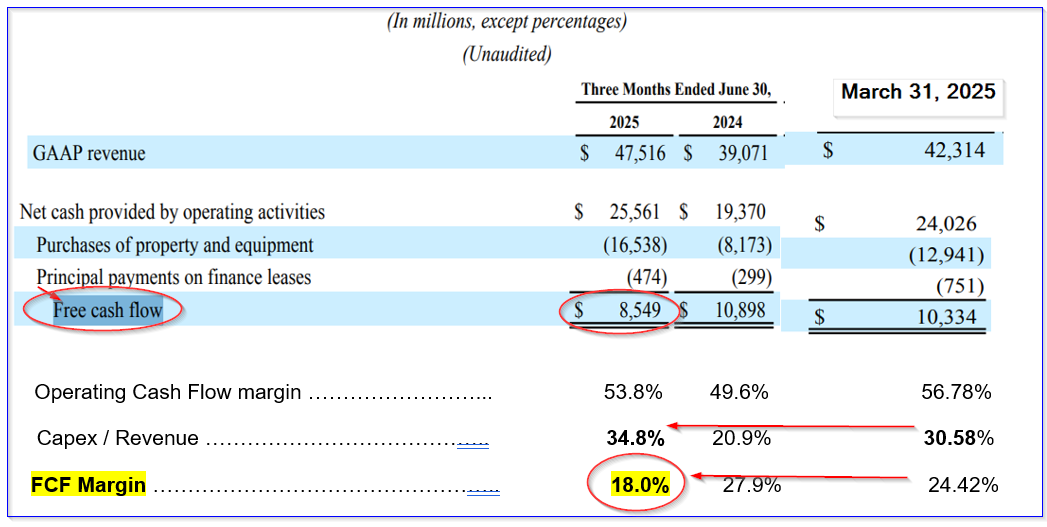

But that was based on a 57.5% operating cash flow (OCF) margin and $70 billion annual capex spending. These figures have to be adjusted after the Q2 report.

For example, Meta Platforms' OCF margin fell from 56.78% in Q1 (as I showed in my May 9 Barchart article), to 53.8% in Q2, as seen on page 9 of its earnings release. Moreover, capex spending rose from 30.58% of sales in Q1 to 34.8%.

On top of this, Meta Platforms now expects to capex spending to range between $66 billion and $72 billion this year. That's up from $64 billion on the low end. In effect, management has raised the midpoint capex spend projection to $69 billion from $68 billion. It also raised other expense forecasts by $1 billion.

That implies that META's FCF margin could be lower than expected before. This could have a lowering effect on the stock's value.

Target Price for META Stock

For example, analysts now project that revenue this year will reach $195.22 billion and $221.78 billion in 2026. That is higher than the $213.41 billion 2026 forecast in my last article.

However, the operating cash flow (OCF) margin we used before was 57.5% and this now seems too high. Using a 53.8% OCF margin taken from Q2:

$221.78 billion 2026 revenue forecast x 0.538 = $119.34 billion OCF

This is lower than my previous forecast of $122. 71 billion in operating cash flow. Moreover, capex spending will be at least $70 billion next year, so the FCF will be lower:

$119.34 billion - $70 billion capex = $49.34 billion FCF

That works out to 22.2% of the projected 2026 revenue of $221.78 billion, higher than Q2's 18% FCF margin.

Let's see how that might affect META stock's value.

Using a 2.50% FCF yield metric (i.e., assuming that 100% of FCF is paid out and the stock has a 2.50% dividend yield), META would be worth:

$49.34 billion FCF 2026 / 0.025 = $1,973 billion market cap.

But that is only slightly higher than today's market cap of $1,957 billion, according to Yahoo! Finance.

However, Stock Analysis shows that over the last 12 months, Meta has generated $50.137 billion in FCF. Using a 2.5% FCF yield metric, that implies META is worth over $2 trillion:

$50.13 TTM FCF / 0.025 = $2,005 billion

$2,005 billion mkt cap est./ $1,957 billion mkt cap today = 1.026 -1 = +2.6% upside

Therefore, META is worth 2.6% more, or $800.85 per share

This is lower than my previous target price of $854.19. In other words, META stock may be fully valued here.

Analysts Not So Sure

Yahoo! Finance reports that the average of 68 analysts is $823.50 per share. However, Barchart says its survey shows a mean price of $757.98 and AnaChart.com reports that the average of 54 analysts is $776.56. Stock Analysis says 47 analysts have an average price of $785.93.

This puts the analyst survey average at just $786.00 pert share, only slightly higher than today's price.

The bottom line is that using a FCF margin analysis and averaging analysts' price targets, META stock may be close to its full value here. This could change if the company's operating cash flow margins improve or the market decides to value its free cash flow higher.

As a result, investors may want to be careful here, especially if they expect META stock to skyrocket higher. FOMO trading rarely works out.

It may turn out, in effect, that shorting out-of-the-money (OTM) put options in nearby expiry periods is a better way to play META stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.